For the first time this year many financial institutions will have included derivatives at their fair value on balance sheets and, in many cases, this will have been a major headache.

Although fair value accounting became mandatory for larger banks and building societies in 2005, it has only become a requirement for smaller firms recently and must now be evident in their accounts. There is also a lot of evidence that all ‘big 4’ accounting firms are tightening up their procedure for auditing hedge accounting for both new FRS 102 transition clients and established IFRS clients.

Fluctuation in interest rates from one period to another causes the fair value of interest rate swaps to change materially and, as a result, there is potential for large volatility in reported earnings and profits. The numbers are often material and so the accounting is very important.

The accounting standard IAS 39 was amended back in March 2004 to specifically allow a portfolio approach to hedge account for a fair value portfolio of derivatives used to hedge interest rate risk. This was particularly helpful to banks who hedge interest rate risk in the banking book (IRRBB) on a portfolio basis. IFRS 9 (IAS 39 replacement) has not yet replaced portfolio or macro hedge accounting and so currently the only way to account for a portfolio of derivatives rather than individually is to adopt IAS 39.

However, in order to follow the relevant guidelines (AG114 – AG132) many banks have adopted this portfolio hedge accounting approach where constant, eg monthly, amortisation adjustments for de and re designation are required.

The complex guidance requires that the hedge item amount is fully tracked between the prospective and retrospective stage, the only way to keep track is to amortise off all the hedge adjustments and amortise on all the hedge adjustments every month, and that way you know you have it right.

If your portfolio has 60 time periods, this means 60 new adjustments every month, leading to many thousands after a few years. These adjustments are often made on large spreadsheets, introducing the risk of human error. Importantly the adjustments can cause the value on the balance sheet to become distorted from the true economic fair value and the accounts can also distort what is actually happening between the hedge and the hedged item.

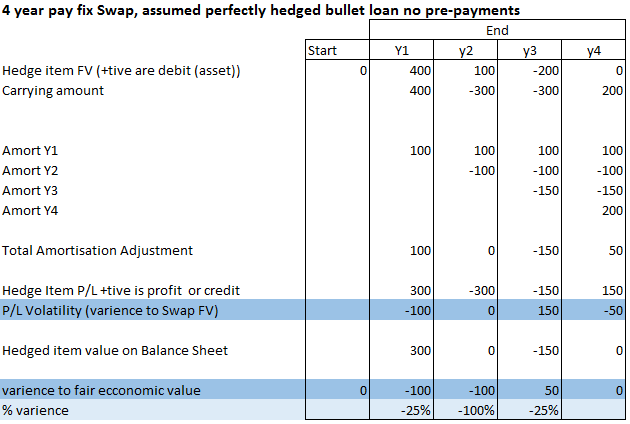

The example below shows the treatment for a simple theoretically perfectly hedged bullet loan with no expected pre-payments. The example shows how the carrying amount is amortised out each period and we can compares this to its true economic value. In this simple example, the balance sheet value and the true economic value are materially different, and even a theoretically perfectly hedged scenario shows material P/L volatility. Surely this is not the best way to perform hedge accounting.

It is however difficult but perfectly feasible to adopt open portfolio hedge accounting, allowing a firm to take an open portfolio of interest rate swaps and apply the concept of dynamic hedging without the need for constant adjustments.

With this in mind, the ideal software will properly calculate the value of the designated hedged item while following the very specific rules laid out in AG126 and AG 127. It will include the individual loans and have the ability to calculate their fair value based on expected cash flows and can track actual pre-pre-payments between the prospective and retrospective stages. If it can’t then we go back to the headache of de designating every month and amortising the fair value out.

Surely adopting a cleaner approach to hedge accounting, that doesn’t require all of these adjustments, is essential, where the hedged item amount reported always reflects the economic value of that hedged item without any distortion?

For more information on ALMIS® International and our solution go to Hedge Accounting or contact us T: +44 131 452 8898