This article explores

- What is Earnings at Risk (EaR) and the importance of managing this risk.

- The different approaches to measuring EaR.

- How ALMIS® International can help you manage this risk.

What is Earnings at Risk (EaR)?

EaR is a measure of the estimated impact to a bank’s earnings under an economic scenario. Whereas Economic Value of Equity (EVE) – another key measure of IRRBB that measures the sensitivity of the net present value of repricing cash flows to an interest rate movement – is primarily a concern to the Treasury function and the regulator, EaR is a metric with business-wide implications. Institutions, whose earnings have an overly elastic sensitivity to interest rate movements, could see effects such as their profitability and dividend capacity reduce; erosion of key investor metrics and share price reduction; or operational impacts, such as lower capital expenditure capacity or reduced bonus pots in the event of an adverse movement in interest rates.

EaR arises where the structure of a firm’s balance sheet does not allow them to adequately reprice their balance sheet to maintain their net interest margin (NIM) and typically meaning the interest they are paying on their funding increases more than (or decreases less than) the movement in interest they are earning on their assets.

Understanding and satisfying Regulatory Requirements

There is no formal return that firms must file to calculate or disclose an earnings metric, unlike the FSA017 for EVE.

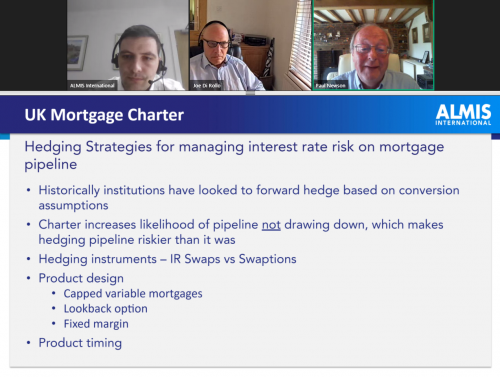

However, 9.1(2) from the Internal Capital Adequacy Assessment section of the PRA rulebook confirms (UK regulated) firms must have a system of identifying, evaluating and managing the risk to earnings from potential interest rate changes. The PRA’s Standardised methodology – positioned as an alternative to a bank’s own internal systems – does not include a methodology for assessing earnings sensitivity and this is consistent with the Basel’s standardised methodology as well. As of 2022, the EBA, however, have introduced both an earnings Supervisory Outlier Test (SOT) and Standardised (& simplified Standardised) methodology.

The PRA do not provide guidance in this section around the appropriate time horizon to consider your earning risk, although the general convention is one year in the UK. The Basel principles suggest firms should consider a horizon of between one and three years and no more than five and the 2018 EBA Guidelines essentially paraphrase this. Under the newer (replacing the repealed 2018 Guidelines) EBA Supervisory Outlier Test (SOT), there is a prescribed one year horizon whereas the Standardised (& simplified-Standardised) methodology a more ‘opaque’ minimum of one year.

It is generally accepted that the longer the horizon you consider the less accurate and meaningful the analysis will be due to the level of assumptions necessary to project the impact.

Approach to measurement

For the purposes of measuring EaR, there are three balance sheet profiles that Basel make reference to in their standards for earnings and IRRBB:

- Run-off;

- Constant, and;

- Dynamic.

A run-off balance sheet, as typically used to manage EVE, is where the assets and liabilities of a firm roll off as items reprice or mature.

A constant balance sheet assumes that as each item on your balance sheet reprices it is replaced by an equivalently sized item and therefore, in essence, the size and composition of your balance sheet remains constant across the scenario’s horizon.

A dynamic balance sheet overlays assumptions of how you expect the composition of your balance sheet to change over the scenario’s horizon.

The most common approach ALMIS® International see firms taking is looking at their EaR on the constant balance sheet basis – also the basis the EBA prescribe for the SOT and Standardised methodologies – but we do also see firms evaluating their earnings on a dynamic modelling basis as well, so we will focus on the benefits and limitations of these two main approaches.

Let’s consider the benefits and limitations of each scenario

The benefits under a constant balance methodology are:

- It gives a much truer representation of the interest rate risk in your balance sheet today.

- It can be very quick to produce. No inputs or assumptions are required to be computed and collated from the business.

- It makes comparison easier. By using a consistent methodology any period on period movements have a better and direct correlation to increases / reduction in risk on your balance sheet.

The limitations of a static balance sheet are:

- It doesn’t represent the true risk your balance sheet will face as it is improbable your balance sheet will remain constant over the horizon.

- It doesn’t capture risk from growth, product mix changes, strategic shifts.

- It can lead to a false sense of security if the risk appears low, but may not be under evolving conditions.

- It is less useful for long term decision making and planning.

The benefits to using dynamic balance sheet modelling:

- It can be a truer representation of the interest rate risk that will be faced by the institution as it takes account of the expected activity the business will undertake.

- It can allow an institution to take into account the micro-economic behaviours of new/existing customers under different scenarios e.g. a propensity for higher-yield, term deposits than lower-yield, open maturity deposits in a rising rate environment.

- It allows for better proactive risk management through early identification of risk.

- It aligns the risk management with the strategic direction of the business.

The limitations to using a dynamic balance sheet are:

- It is complex and time-consuming to perform as it requires the modelling and validation of assumptions from across the business.

- It is more resource intensive and requires more data, insight and expertise to produce and analyse.

- The output is highly sensitive to assumption risk as the meaningfulness of the output can only ever be as accurate as the assumptions feeding the scenario.

- It can be difficult to segregate the risk between what exists on your balance sheet today and what is being introduced through expected activity.

Many of ALMIS International’s clients have adopted a static approach due to it’s ease and speed to implement and assess. However the Basel principles do infer that institutions may opt (or need) to monitor their EaR under different approaches. Ultimately, the board and managers of the institution need to consider the appropriate approach for measuring and evaluating this risk, alongside any conversations with regulatory supervisors. And, upon implementation of these, it is critical to the management of the risk that the methodology is understood, along with any limitations. Internal education is key to this and ensuring that the ALCO and other relevant committees have the appropriate expertise along with the necessary training in order that the key messages are understood and that effective challenge can be provided.

Margin & Balance Sheet Report

A foundation report of ALMIS® Front Office, this allows you to produce your balance sheet for today and drive meaningful insight into your current NIM position. When combined with ALMIS® Front Office’s forward and backward looking capabilities, this can give you insight into not only where you are today, but where you were and where you are going.

Static Earnings At Risk

ALMIS® Front Office’s turn-key and comprehensive EaR sensitivity function allow you to calculate your EaR on a constant balance sheet basis across user definable time horizons, where one year, two years or beyond. You can easily apply parallel shifts – for example to model the EBA’s SOT 250bps parallel shift for GBP exposures – but also flexible to allow you define more complex and intricate interest rate scenarios you can define at categories, product or interest rate markets.

Key benefits of ALMIS® Financial Planner

Financial Planner is a powerful tool within the ALMIS® Front Office solution providing clients with the ability to use their existing balance sheet to automate the calculation of forward balance sheets using comprehensive user-definable scenarios.

Adapting to change is key with Financial Planner you can create forward plans over a long period using monthly, quarterly or annual intervals or you can create weekly, or even daily plans depending on your needs.

Embed your business assumptions to build out the resultant balance sheets. With a user friendly interface you can interface data from Excel as well as comprehensive range of modelling assumptions, including:

- Assumptions around business retention and roll-over.

- The different characteristics and types of new lending and new deposit at business line or product level.

- Model asset acquisition or asset disposals.

- Embed expected assumptions around arrears, prepayment and early redemptions.

- Model you funding requirements.

- Depreciation and accounting adjustments.

- Any capital raising activity and adjustments.

- Incorporate overheads including fee income, management & capital expenditure and provisioning.

Through the application of these assumptions to your existing balance sheet ALMIS® Front Office will project forward the resultant balance sheet position and allow you to see impact of this through a suite of detailed reports outlining the resultant interest income and interest expenditure (and other income statement entries) as a consequence of your plan, but also enabling all of the standard ALMIS® Front Office functionality on these positions as well.

Report Writer

Whilst ALMIS® Front Office holds a wealth of rich information, what is essential in order to drive out value from this is being able to flexibly and efficiently present this in a manner that can be put in from of Senior Management, ALCO and other committees. In being able to do so efficiently, this allows time to be invested in the analysis and understanding of the drivers rather than spent in the manual production of charts and graphs. The ALMIS® Front Office Report Writer enables this precisely by offering a ‘one-click’ solution to publish an array of ALMIS® Front Office data and reports directly to Microsoft Excel and allowing you to:

- Build custom reports by automating the publication of turn-key reporting directly to Microsoft Excel.

- Pull data together from multiple reports calculated in ALMIS® Front Office.

- Incorporate current balance sheet data with prior month comparatives and forward looking forecast data.

- Incorporate ALMIS® Front Office data with other external data sources.

- Leverage off Excel functionality to build automated graphics for inclusion in ALCO packs, board papers and other MI reporting.

Summary

Earnings at Risk is a subset of Interest Rate Risk in the Banking Book that will affect all institutions holding assets and liabilities that have asymmetric repricing characteristics. Failure to manage EaR can result in tangible consequences that can be felt across all functions of the institution. There are different methodologies that you can employ to assess your EaR measure and these differing methodologies have different benefits and limitations, both in terms of what they are telling you and the effort required to produce meaningful analysis. Institutions need to balance the practicalities and data requirements in producing the analysis with the speed, resources and assumptions required and critical to the value this analysis can provide is ensuring the approach and measurement of this metric is understood.

About the Author

Stuart Fairley is Head of Client Experience at ALMIS® International and works closely with clients in his role. Prior to joining ALMIS® in 2019, Stuart had spent most of his career working in the bank and building society sector and holding a number of finance and project roles. Stuart is a also member of the Chartered Institute of Management Accountants (CIMA).

Market leading experts in controlling risk, ALMIS® has been developing solutions to deliver accurate information on current and forward-looking positions for Treasury to proactively manage and plan. If you want to find out more book a demo.